Price discrimination may sound strange to people, but it’s a strategy used by companies to take advantage of the willingness to pay by different groups of people.

Large companies and great marketing strategists use this technique. Smaller companies do not really employ it, so I would like to dig in a bit more and give an overview on the benefit of price discrimination.

It’s a very sensitive topic, so if you apply this to your company’s strategy, make sure you do it in the right way, because if poorly managed it could prove to be anti-productive, but if well managed it can really drive your profits through the roof.

In marketing, pricing strategy is really important. The choice of a price needs to be thoroughly analyzed and cannot be dealt with superficiality.

If you have a maximum price for which different segments are willing to pay, do you set up a lower price in order to make everybody happy?

If this is how you conduct your business, you might lose a big opportunity, not only to make much greater profits but also to generate a competitive advantage in caparison with other brands.

The ability to get the best price from the richer client and to offer a better deal to other groups may sound unfair, but it’s used constantly in brands not only to increase profit but to create even more loyal clients and enhance the brand advantage .

Allow me to explain:

What is clear is that clients that buy a different product will have different prices. But we need to understand what happens when the product is the same but the price is different. An example is a student discount; the same product at an adult price. Or think about an airline, train a bus trip or even hotel accommodations.

Some of those services are the same, for example, an economy class for an adult will be the same service that will cost the same money to the company but it is sold for a much lower price. So in this case companies take advantage of another market segment with less spending ability. If you think they were doing it because they feel sorry for the students and they want to make them travel then you are very naïve J, but I need to admit it’s a good excuse so don’t complain about it.

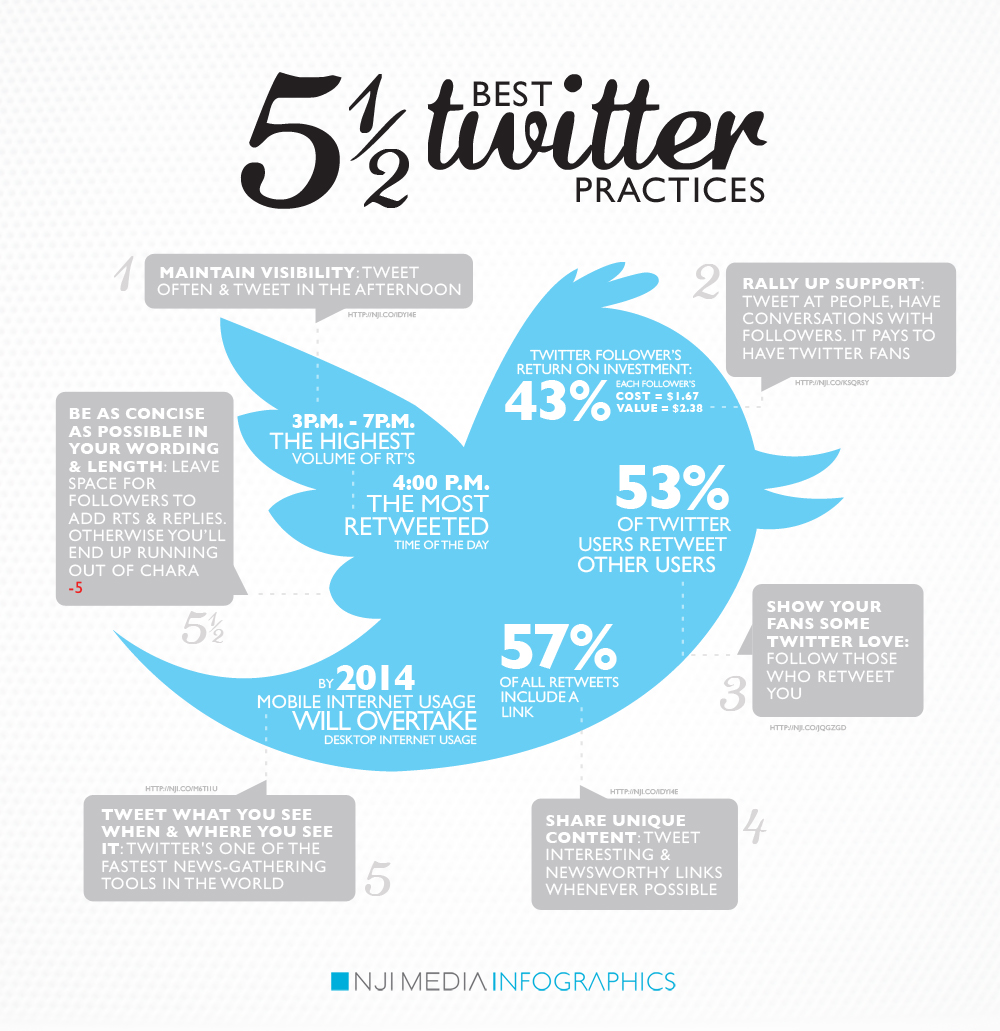

The Internet gives us a chance to negotiate with individual prices. I think such approach is similar to Alibaba.com who gives an attractive price range, but then they negotiate with the individual buyers.

This reminds me of an old trick of a Chinese supplier who would let me choose two products at different prices to assess my knowledge and my approach to them before giving me a price. Testing me gives him an edge on my willingness to pay, my perception of quality and my attitude towards certain products. With the Internet, brands can get information on demographics, interests, age, etc.

First Degree

Companies that negotiate prices individually use a tool called first-degree price discrimination and it’s easier to apply to e-commerce brands.

Second-Degree

Second-degree price discrimination is considered more like an indirect method.

Second degree implies that firms offer different deals, (in quality and quantity) and consumers self –select based on their willingness to pay and their tastes. In this instance , you can be more generic; you don’t need to know everything about your consumer. You can select groups that prefer different products.

This can be done through:

- Nonlinear pricing

This means you can have a more expensive price for the first quantity and then a lower price if you buy more products or use more of the services of the company.

This quantity discount is used by many brands, mostly telecommunication companies. They offer different products that allow a bigger discount based on how much you use the product.

- Versioning

Firms offer different versions of their product, so a lower quality can have a cheaper price and allow targeting a segment with a lower income.

However, you need to be careful not to make the mistake of making the product substandard (which sometimes costs more money) and sell it at a reduced price. An example can be some software versions if you think about it. Sometimes you can buy software with a limited functionality for a cheaper price. In this case, the company had the premium version but then spent money and time to make it less functional in order to appeal to consumers with less ability to spend.

They spent more money and they are receiving less revenue for their product.

- Bundling

Some consumers prefer some product more than others, and sometimes firms can bundle products together making an attractive price for buying several products together. This is also used to promote a new product. This can reduce consumer heterogeneity (which I am not sure is a good thing in a centric customer world) and in this manner you can sell more products to more segments and increase profit.

Rather than decrease prices for example to attract more buyers, you can bundle products together at an attractive price but not so low as you would need to in order to sell to people not really interested in the product.

For example, you are selling a specific product X , Y , and Z:

Your buyer group 1 is willing to pay $50 for X, but not interested in Y, unless it is really cheap.

You could bundle X and Y at $65 in order to sell more of Y without dramatically lowering the price. You could eventually keep selling Y for $35 to another group interested in that product and willing to pay more, or in this way, the new group could also eventually be interested in buying product X bundled with Y because it seems attractive as a price.

Intertemporal Pricing

Another issue to touch on very quickly is Intertemporal pricing. This is basically the increase or decrease of prices in relation to time.

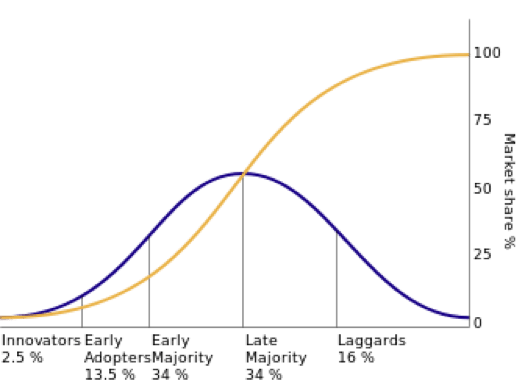

Unfortunately, in high technology or innovative products prices tend to be higher at the beginning and lower as time goes by. So you are punishing the Innovator or the early adaptor – the people who really buy at the beginning and help the diffusion of the product.

If you don’t know what I am referring to please look at the graph below and refer to Theory Diffusion of innovation of Everett Roggers.

https://en.wikipedia.org/wiki/Diffusion_of_innovations *

Price Discrimination

Many consumers that catch the fact that the price of an item may cost less in the future may delay the purchase. This is an issue. It is also inconsiderate to lower the price of an item. It can represent a lack of loyalty toward some customers.

All my real estate investors know that we (the developers) tend to the inverse strategy when we sell a planned project. We increase the price as we sell more units or as we advance in the process of construction. This is great and helps the early investors gain profits compensating them for the initial trust.

*As an external link, this will open in a new browser/window.

Great article I think. I studied some of this in an early business class but never realized really what it meant or the different forms it takes. So, is price discrimination a good thing, or bad thing?

Thanks for the comment. Great question on price discrimination–the answer might depend on which side of the equation you’re on.

Never heard of Intertemporal pricing. Pretty good sample of what that is and how it works.

Thanks Zee! I appreciate your feedback and hope you find my other posts (past and future) useful as well.